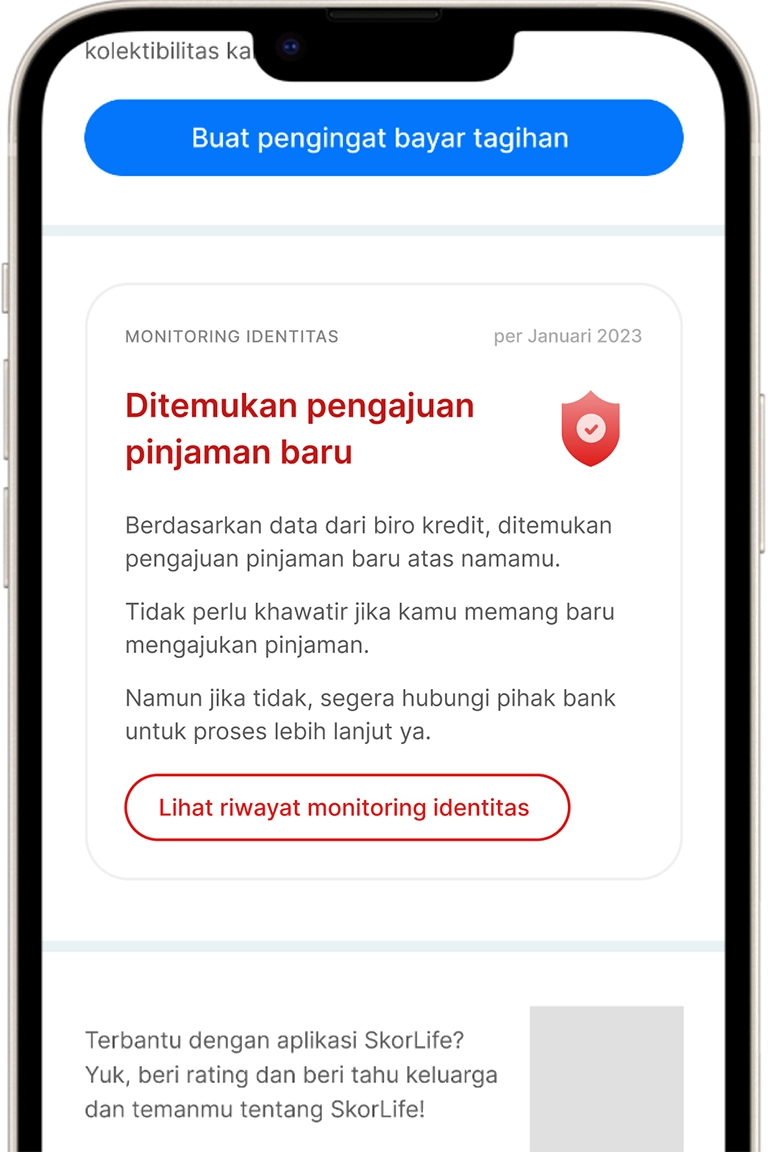

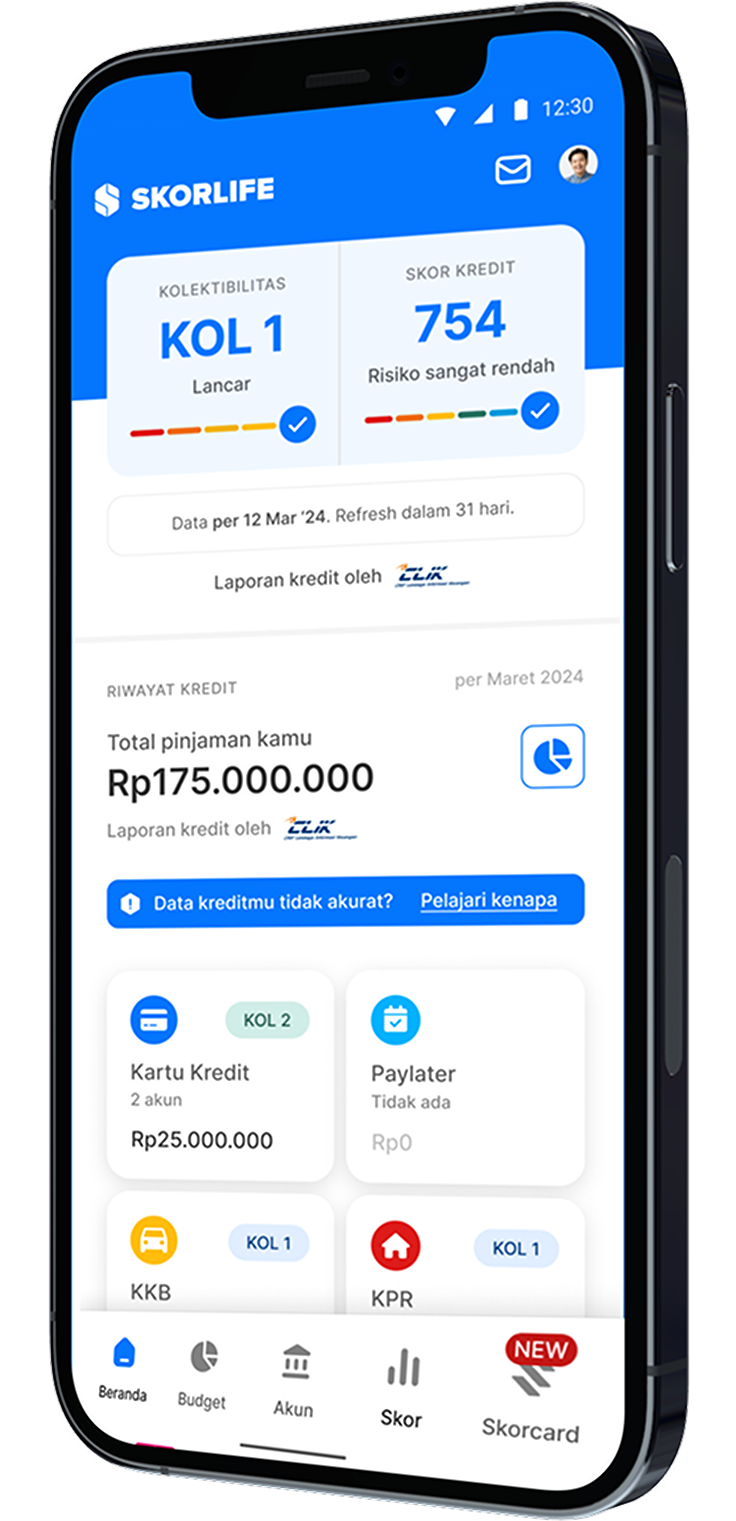

SkorLife protects.

Monitor and take control of your financial reputation.

COMPLETE FEATURES READY TO HELP YOU

in 3 easy steps!

create your account

and completely in app.

for your data protection

securely and will always be safe.

finances after verification

your expenses in SkorLife app.

financial data

in 3 easy steps!

protect their financial reputation with SkorLife

their financial reputation

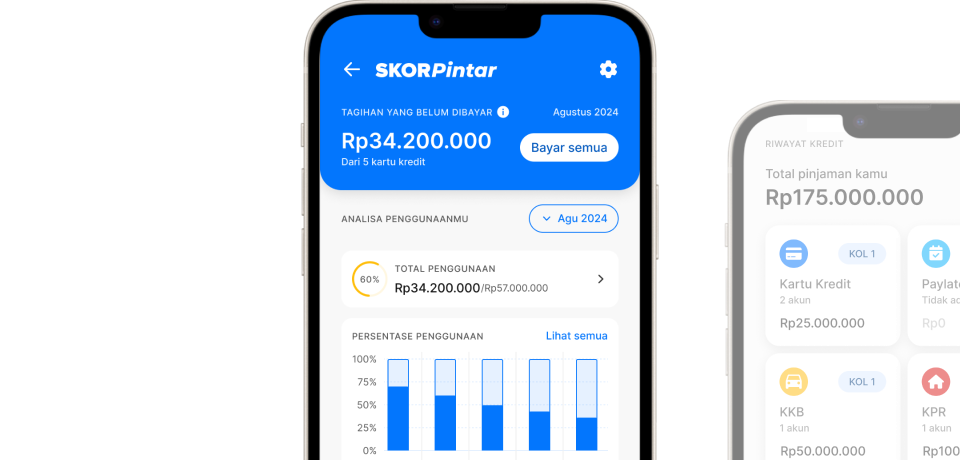

Credit score is a three-digit number that represents your financial reputation based on the quality of your credit/loans. This number allows banks or lenders to evaluate whether or not you are eligible to receive credit.

If your credit score is good, lenders consider that you have managed loans responsibly in the past and have paid all bills correctly and regularly. This makes lenders feel comfortable approving your loan applications in the future.

The credit score ranges are as follows:

- Excellent: 597 - 659

- Good: 562 - 596

- Fair: 520 - 561

- Poor: 320 - 519

- Bad: 150 - 319

To improve your credit score, there are several main ways you can do:

- Always pay bills on time.

- If you have a credit card, try to keep the usage below 30% of the limit.

- Have a good mix of credit types, including both unsecured and secured credit.

- Settle all the delinquent credits you have.

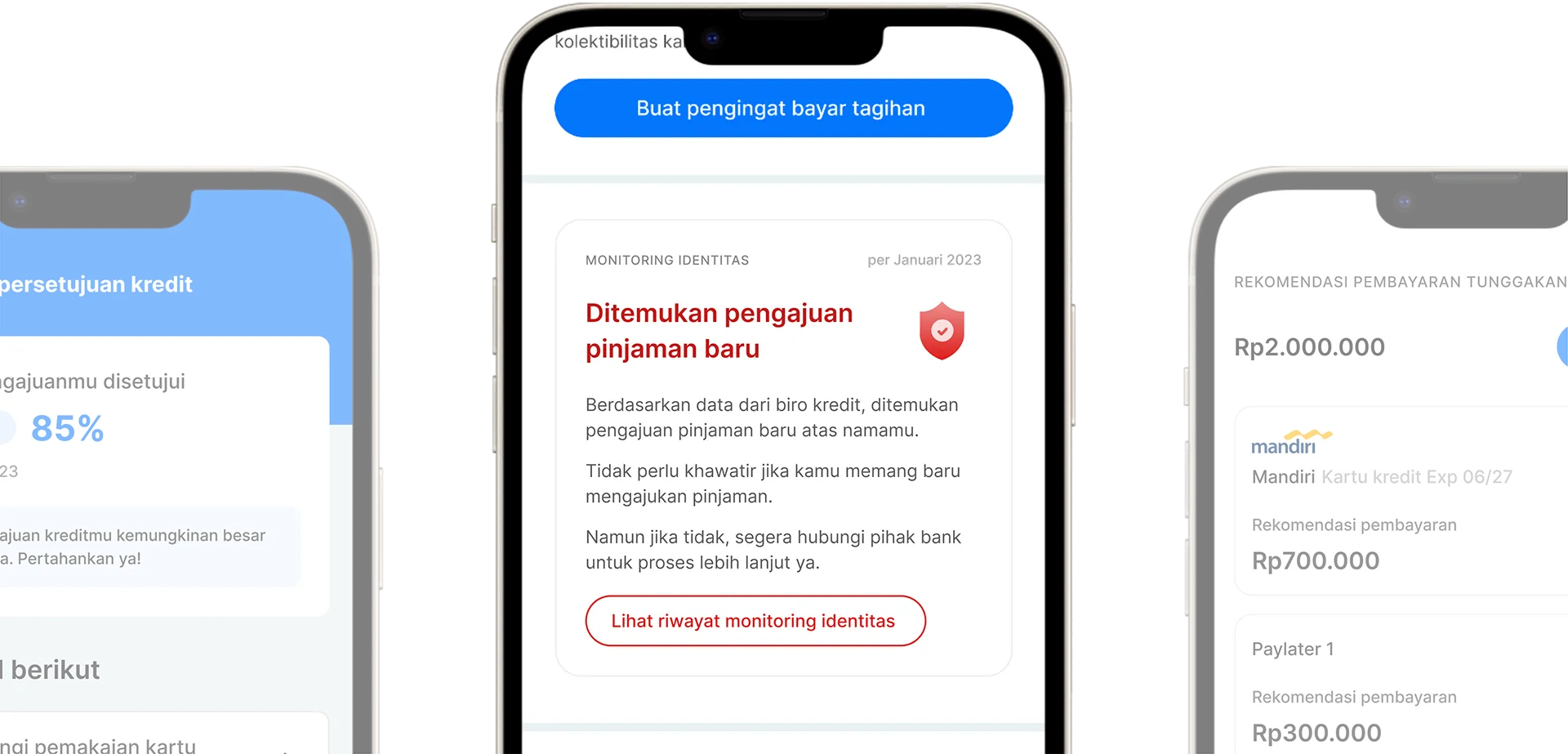

Skorlife partners with CLIK, a Credit Bureau Institution (LPIP) licensed by the Financial Services Authority (OJK). You can obtain a credit report from CLIK and then send it to the Skorlife application.

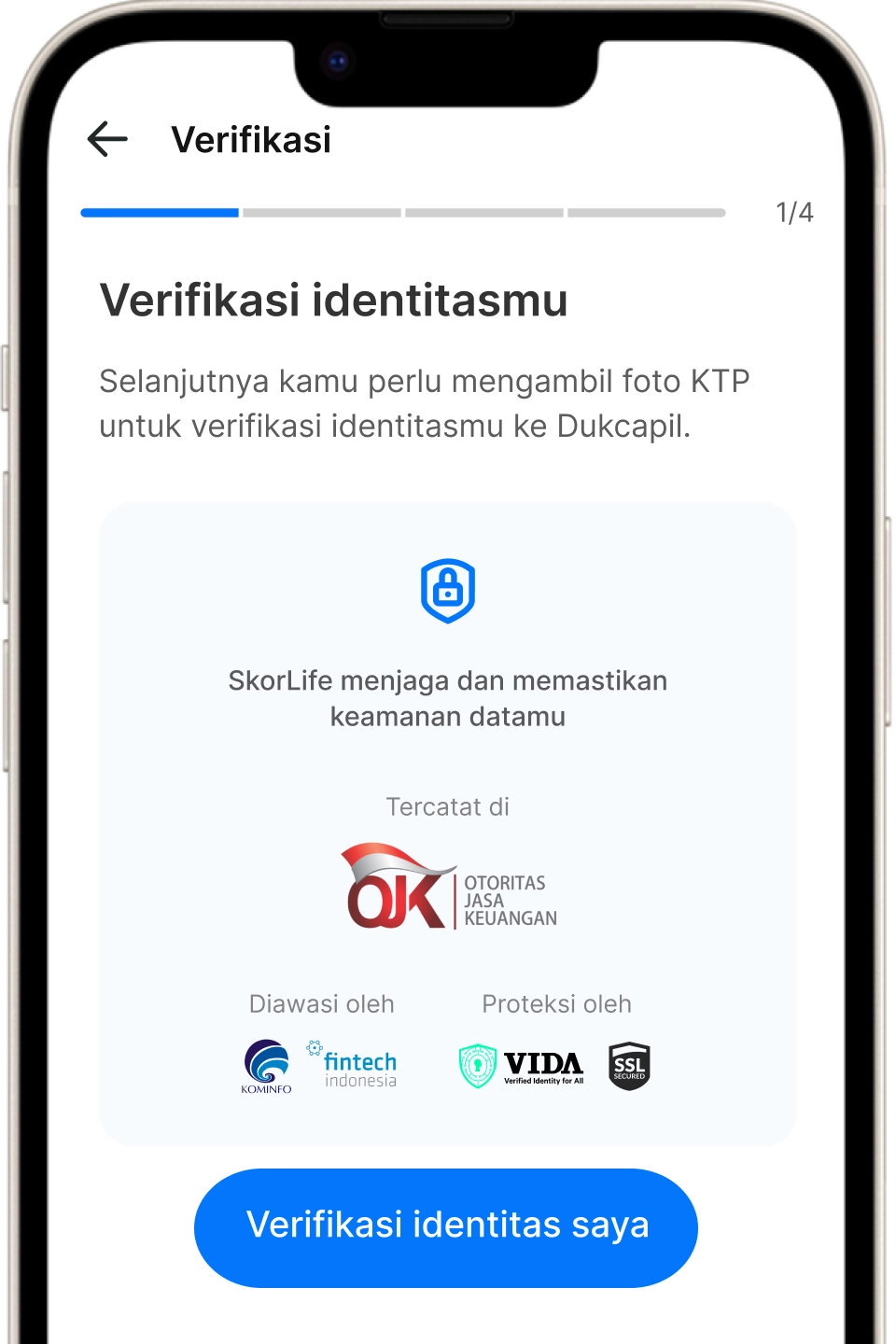

To obtain a credit report from CLIK, as part of the verification process, your data will be cross-referenced with the data in CLIK and the Civil Registration (Dukcapil) database. Skorlife ensures the confidentiality of your data, and only you can access your own credit report.

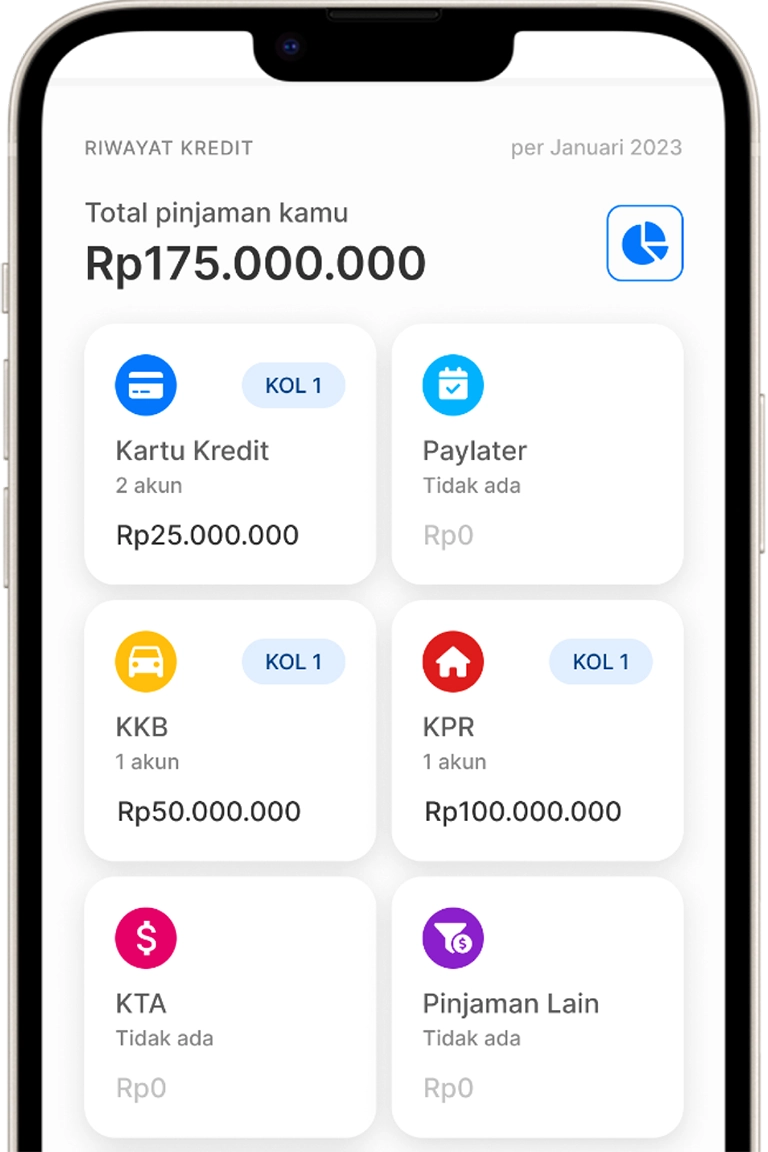

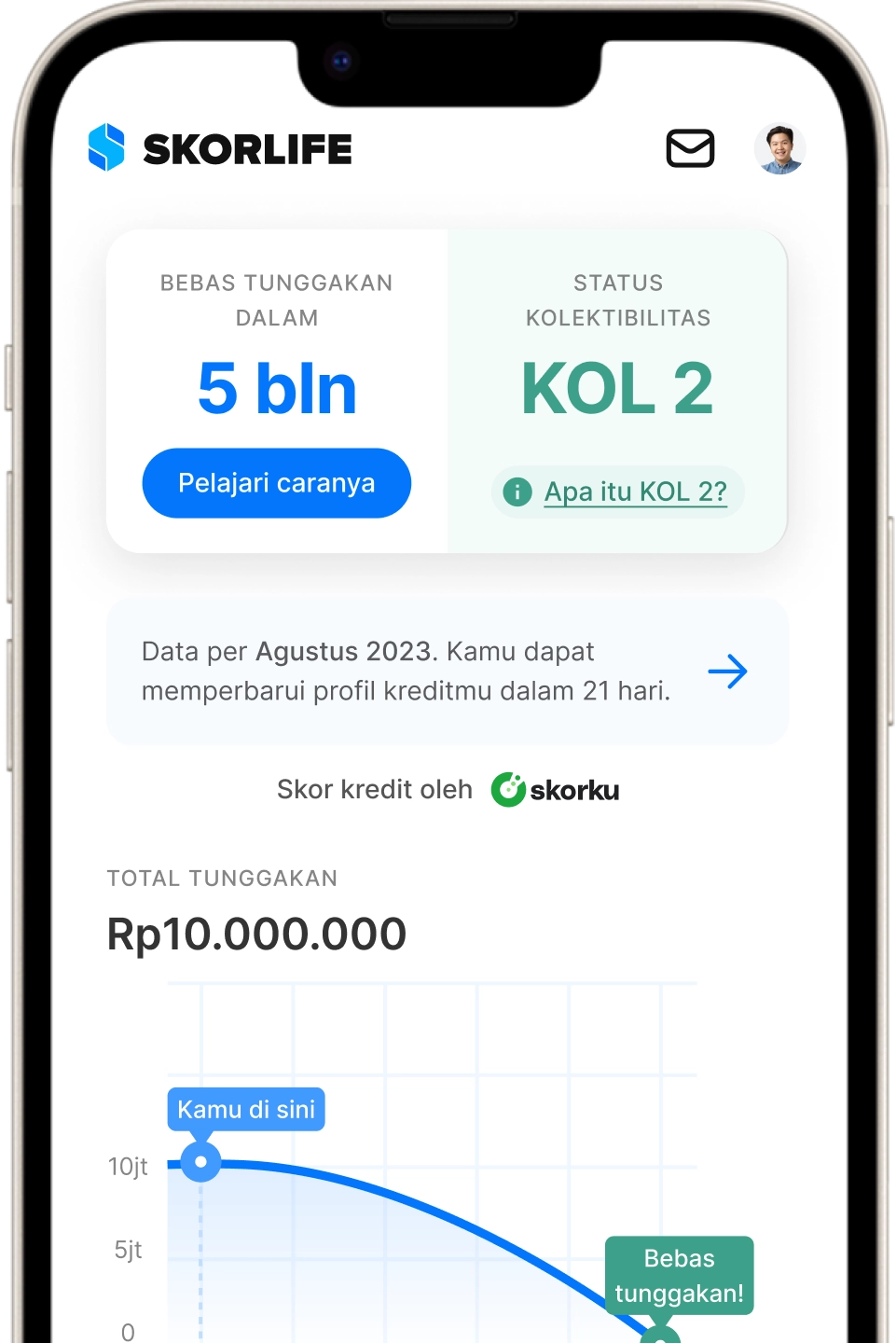

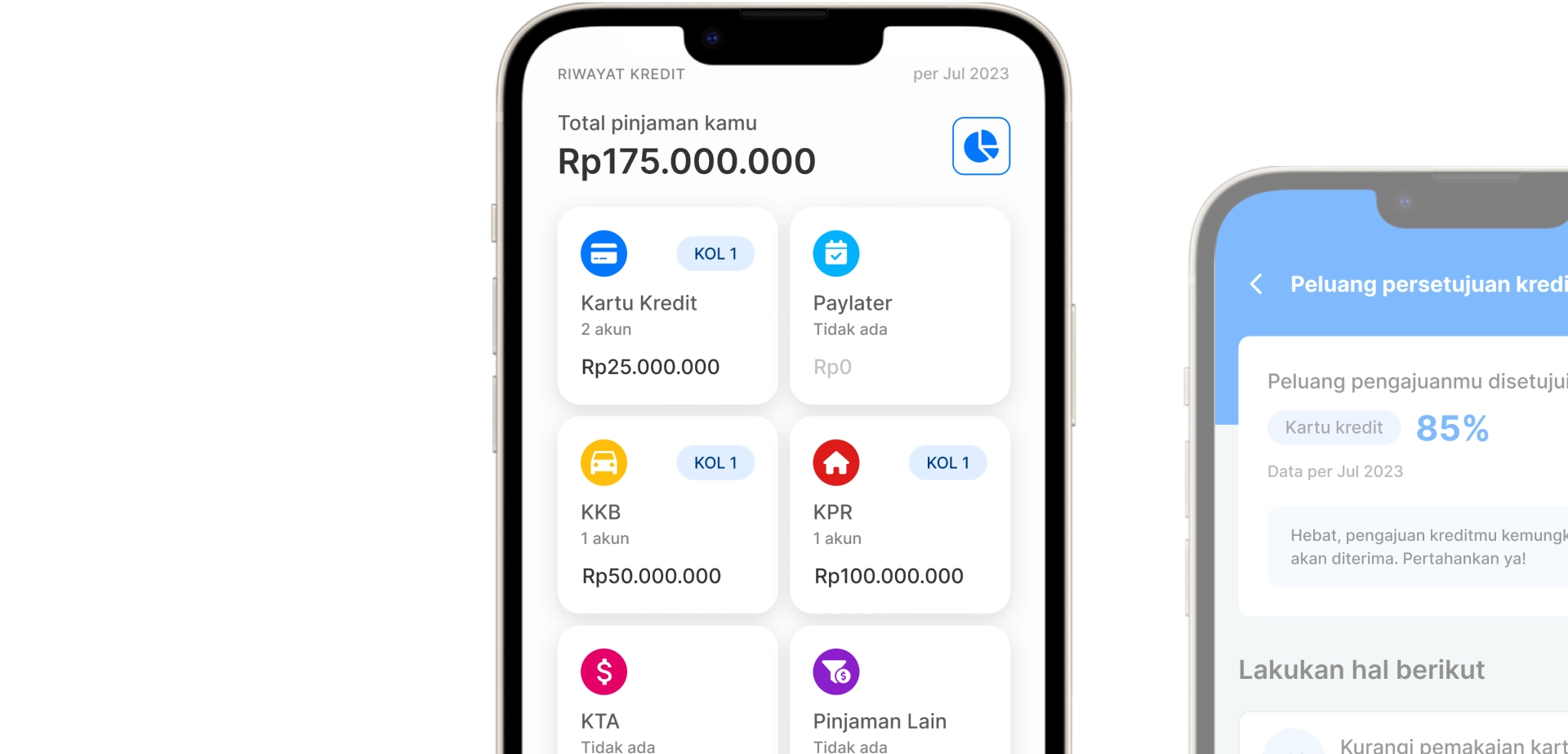

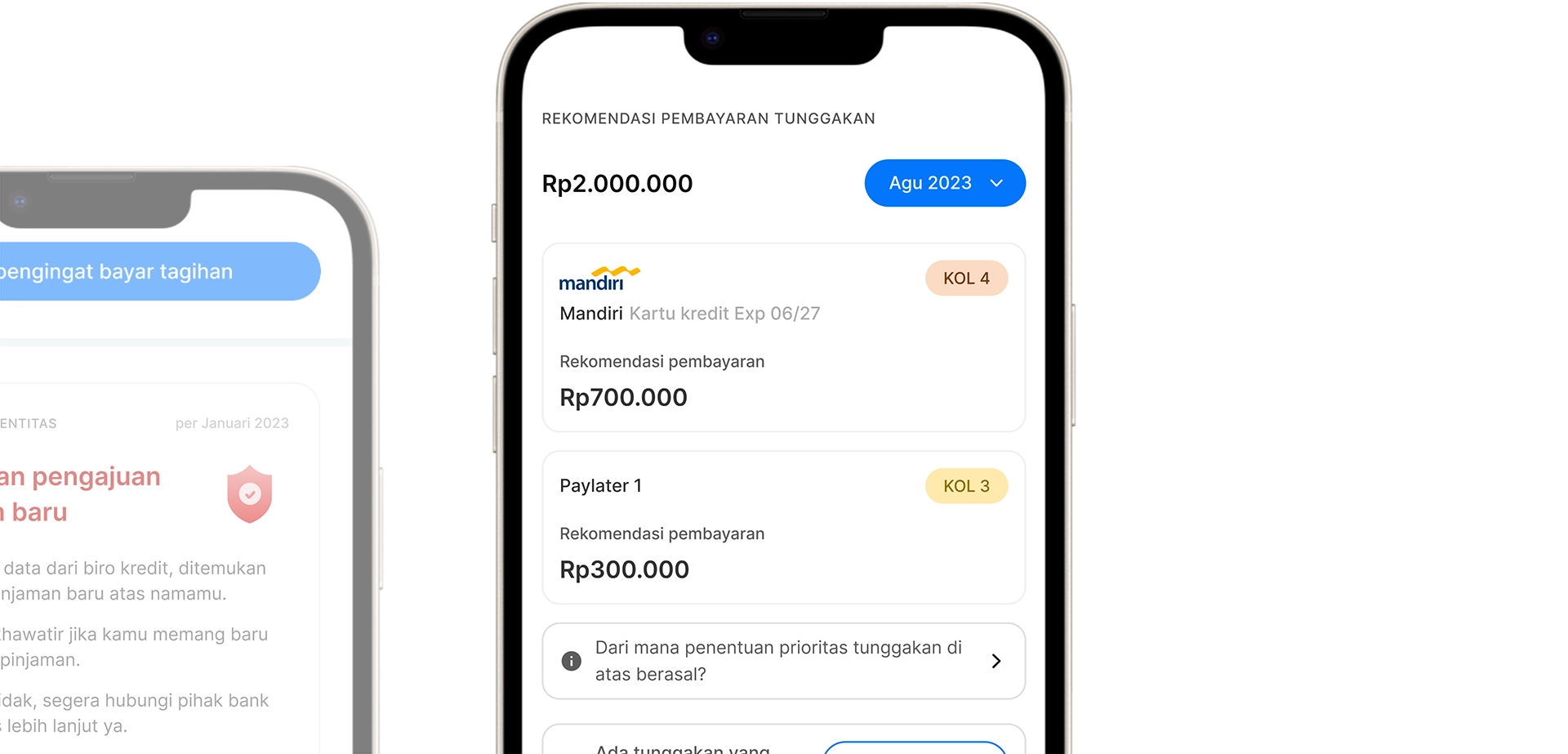

SLIK (Sistem Layanan Informasi Keuangan) is a credit quality standard created by Bank Indonesia to indicate your current collectability status (whether you have delinquent loans or not).

This collectability status allows you to know your current credit situation. There are 5 categories of SLIK collectability status, which are as follows:

| Collectability | What it means for customers? |

|---|---|

| Score (KOL) 1 | Current Credit, which means the customer has no outstanding loan installments. |

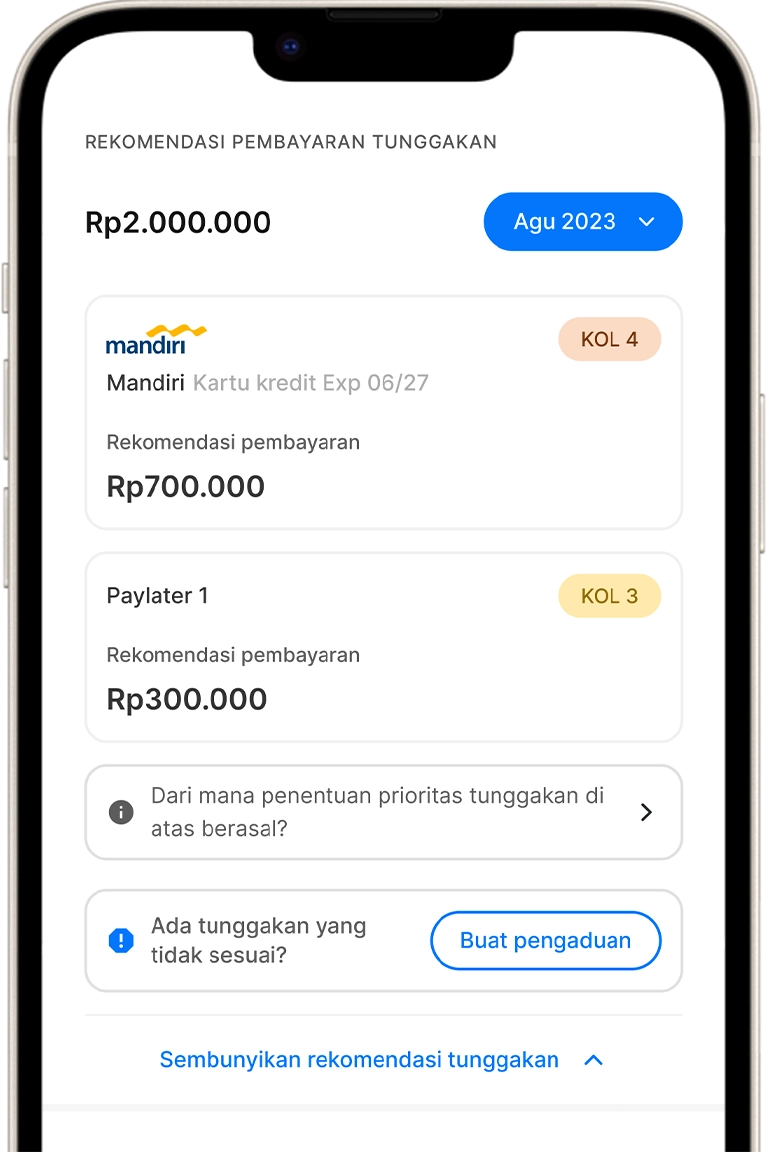

| Score (KOL) 2 | Special Attention Credit, which means the debtor has overdue loan installments for 1-90 days. |

| Score (KOL) 3 | Substandard Credit, which means the customer has overdue loan installments for 91-120 days. |

| Score (KOL) 4 | Doubtful Credit, which means the customer has overdue loan installments for 121-180 days. |

| Score (KOL) 5 | Bad Credit, which means the customer has overdue loan installments for more than 180 days. |

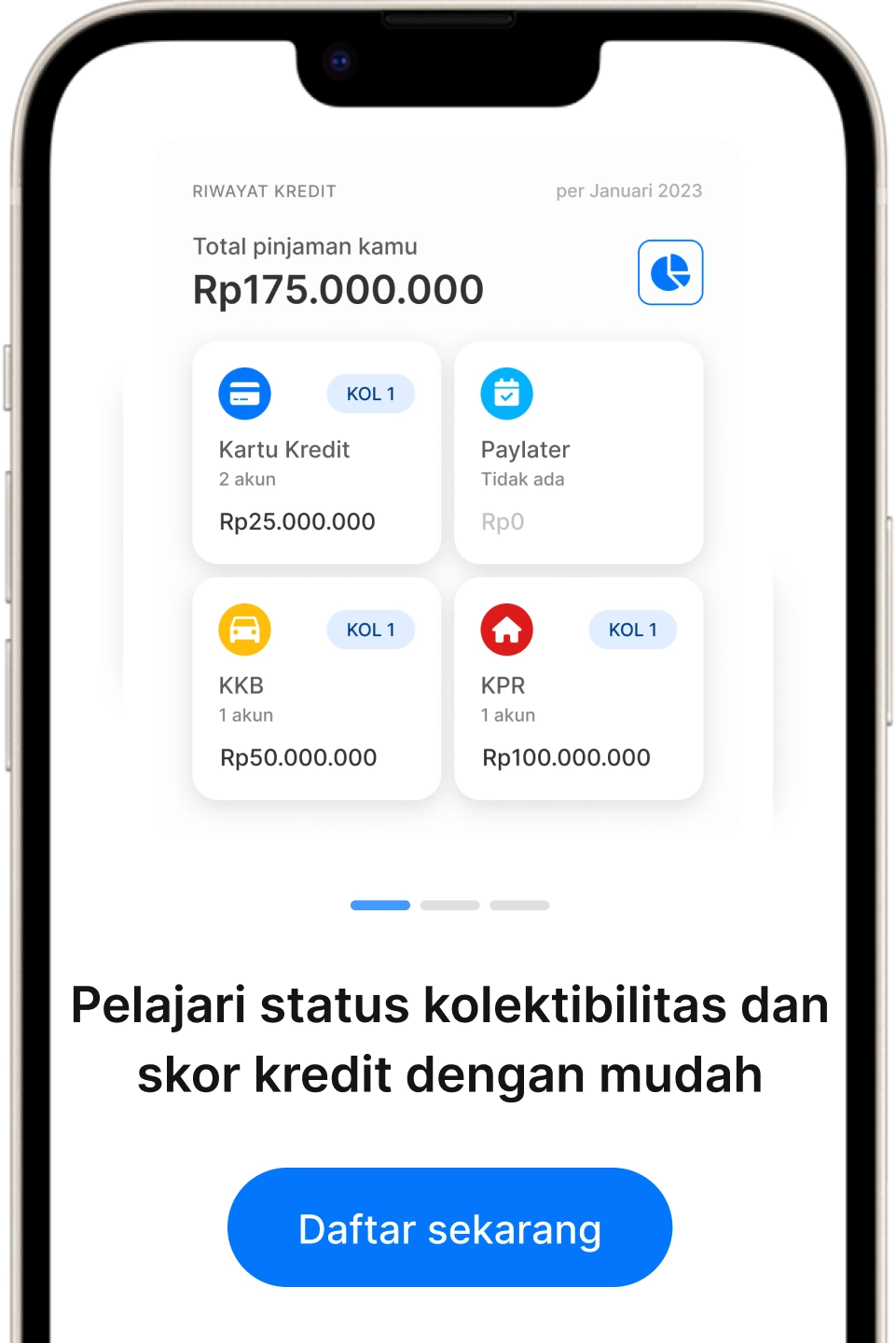

A good credit score will open opportunities for you to access products such as Home Loans (KPR) and Motor Vehicle Loans (KKB), or get lower interest rates.

Credit scores enable banks and other financial institutions to determine whether you can be trusted to be given a loan or not. Therefore, having a credit score and maintaining a good score is crucial.

English

English Indonesian

Indonesian.png)

4.7/5

4.7/5